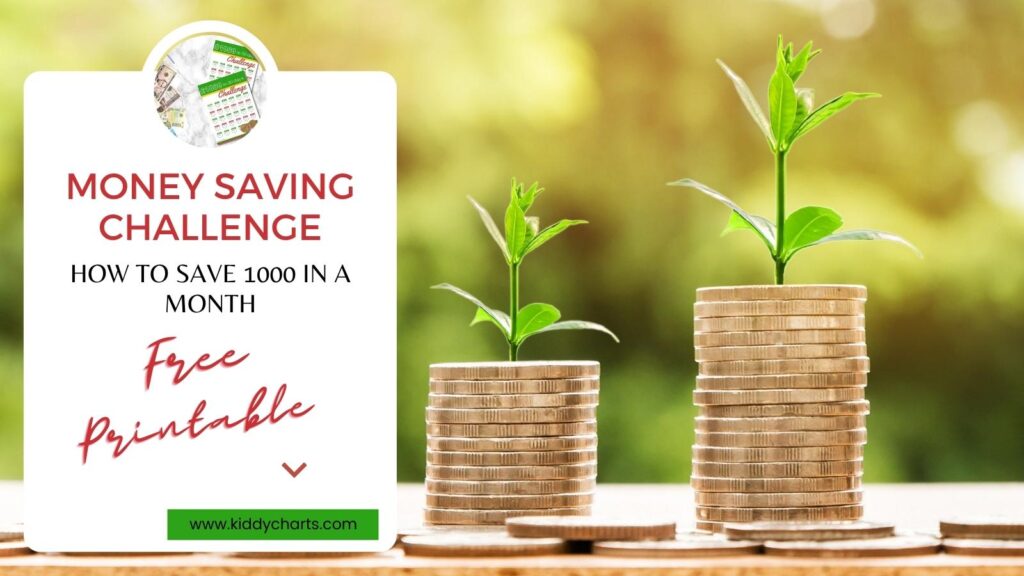

Saving a large amount of money can feel daunting, especially if you need to do it quickly. That’s why we’ve put together this money saving challenge for you, and included a free printable to help you on your way. The good news is that it can feel more manageable than you might think with just a few simple tools and ideas. It can be surprisingly easy once you know where to cut back.

From challenging yourself to save a bit at a time, to using only cash, to setting a strict budget – there are so many small changes you could make that will help you build up healthy savings quickly. Let us give you some tips!

Follow a money saving challenge

Staring off with a large goal for savings is great, but it can lead very quickly to feeling overwhelmed and giving up. Instead, start small and give yourself breaks. Follow our $1000 in 30 days challenge chart, which increases quickly from saving a small amount daily, but regularly drops back so that you have days where you can treat yourself.

It may seem tricky, but that’s why it’s called a challenge! If the worst comes to worst and you can’t make a saving one day, it doesn’t take away from the amount you’ve saved or make the saving any less of an achievement. Seeing this amount add up — no matter how small—serves as proof that you have what it takes to save.

To download this, just scroll down to where we have the button in this article, and it is YOURS! We have a version for Pounds, Sterling, and Euros. Hopefully that is a lot of currencies covered. If we don’t have it in your currency, do drop us a line.

Set a budget

This sounds like an obvious one, but effective budgeting is actually really hard.

The first step is tracking your spending, which means you need to take an in-depth look at how you’re spending money. It’s as simple as keeping all your receipts and writing down every single purchase you make. It’s easy to lose track of where your finances go, even if you’re not obviously overspending. Small amounts of money can just slip away on bits and bobs, and then this amount can add up between pay days until actually you’ve lost a large chunk of money.

Once you’ve taken stock of all your spending, it’s time to cut back where you can. Perhaps it’s simply a matter of cutting back on your food bill and on take out food, or maybe you’re spending more on monthly direct debits than you realise. Whatever the case, it’s time to be more intentional.

When you’ve analysed your spending, create yourself a zero-based budget. This sounds scary but it’s actually one of the easiest ways to budget in order to make a saving. To create this budget, assign every single penny of your income a “job”, so that on paper at the end of the month you are left with zero. Overestimate every area and account for everything – and then whatever you have left after paying for everything goes straight into savings. Acting like you will have no money at all left over come payday is the best way to cut down on spontaneous or pointless spending.

Budgeting like this can be intense, so try to only stick to it for a month and see how you get on! In this period, don’t try to over-pay on debts like your mortgage with your extra money – just focus on saving.

Make sure you’re covered

Saving money can be easy when you’ve got a regular income that covers all your expenses – but what if this income went away? If you got seriously ill or injured and couldn’t work, how would you get by?

If you’ve already got some savings, you might be alright for a little while. However if you’re sick indefinitely and you run out of savings then you’re back at square one. Income Protection can help you out here. It’s a type of insurance cover that replaces a percentage (usually 50-70%) of your income in monthly payments if you get sick or injured and signed off from work.

Having this type of cover can give you some peace of mind – whether you’re trying to make savings or not – and allow you freedom from financial stress in a difficult time.

Use cash

Cash is king, and there’s a reason for that. Sure, we live in a world now where we can pay for things at the tap of a card – and that’s part of the problem. With spending being so simple, it’s easy to not really think about how much money you’re parting with.

If you have to physically hand over your hard earned cash every time you want to pay for something it can help you be more aware of where your money is going. It’s also much easier to stick to a strict budget when you’re using cash, as you can’t spend more than you actually have.

Using cash will help you be mindful and keep a handle on your spending. A great way to do this is to take out enough cash to cover your expenses week by week and keep them in envelopes separated by purpose. You could have a “food” envelope, a “fuel” envelope – and more! Once you’ve run out of money in one envelope, it’s gone and you can’t spend more on that thing without taking from another envelope. If you’ve got any cash left at the end of the time period, put it right into savings.

Raid your pantry before food shopping

For many people, their food shop is one of the priciest parts of their outgoing expenses. This is especially true for families with lots of little ones, and even more accurate if any of the little ones are picky eaters.

Before food shopping, raid your pantry. It’s likely you have multiple meals worth of dried or frozen food squirrelled away – and for every night you can throw together a pantry meal, it’s another night you don’t have to spend your pennies on a food shop. This means – you guessed it – you’re likely to make a saving on food and maybe even come in way under budget.

What are your favourite saving tips?

Obviously, you would like the printable resource now, so here it is, click on the button below to grab it.

We hope you like this resource, if you do, check out some of the other financial resources that we have on the site as well.

Budgeting content on KiddyCharts

Here are some other ideas about budgeting on our site - why not go and take a look?

Simple tips for budgeting when you are starting a family

Ideas for budgeting when you are looking to start a family.

4 rules to live by for feeding a family on a budget

Great rules to live by when you are feeding a family to a tight budget.

Six week family meal plan

An amazing six week meal plan to help you with your budgeting - we KNOW this will make a massive difference to you all.

In addition to the above, we do also have a fantastic resource for saving for a house deposit too, so do check that out as well.

If you like this article – why not sign up to our newsletter?

Thanks so much for coming to see us as well, see you again soon.

Helen

This is a collaborative post.