As a parent, you want the absolute best for your family. You take pains to enlighten their lives and secure them a prosperous future; however, where do you start when it comes to investing? Fret not! This blog post will provide useful insight into smart investments every mindful parent should consider when forming financial security for the ones they love most.

But first, let’s consider why it is prudent to invest in the first place. Note this article focuses on US investments.

Why invest?

Investing can be a great way to build wealth over time and secure your family’s financial future. It also provides an opportunity for diversification in your portfolio which can help reduce risk and increase potential returns. Additionally, some investments may offer tax benefits to help you save money in the long run.

As parents, it’s important to think about your family’s financial future. Building wealth through smart investments can help you achieve your goals and provide financial security for your loved ones.

Invest in education

Being a parent is an incredibly rewarding, yet challenging job. You probably don’t need us to be telling you that 😂. Providing your children with the best opportunities to build their future success starts with providing them with quality education.

By doing so you are investing not just for today, but also laying down the foundations of long-term achievement and growth.

Here are some ways you can invest in education:

529 Plans

Start saving early for your child’s education. If you’re looking to provide your child with a head start on their educational goals, consider investing in a 529 college savings plan. It’s an investment account specifically designed for education-related costs that can help make the cost of higher learning more manageable and secure tax benefits at the same time!

Coverdell Education Savings Account (ESA):

A Coverdell ESA is another type of educational savings account that allows you to save up to $2,000 per year per child under 18 years old. These plans come with a broad range of investment options and can only be used for qualified education expenses.

Invest in real estate

Investing in real estate is a reliable strategy for creating wealth. Property values often rise over time, so when you make an investment now, you set yourself up to benefit from the long-term growth potential of your assets.

This kind of asset management will not only secure financial stability for your family today but also lead them towards passive income and economic security into the future!

While there are multiple ways you can invest in real estate, here are some that we recommend:

Rental properties

Investing in a rental property can help you achieve financial independence while building wealth. With the added income from tenants, and with increasing value over time, purchasing this type of real estate is an ideal way to expand your portfolio. Additionally, leveraging it with a mortgage allows people to make their money work harder without having to pay everything out of pocket right away (although sometimes it’s not ideal)

REITS

Investing in Real Estate Investment Trusts (REITs) is a great way to get exposure to the real estate market while skipping out on notoriously challenging aspects such as tenant management and repairs. However, REITs can be more costly than traditional direct investments, but they offer greater liquidity for your money.

Invest in asset protection

Your biggest financial resources are undoubtedly your valuable assets like vehicles, real estate, and other belongings.

Taking proactive steps to safeguard these possessions is an essential part of maintaining a healthy money situation – enter asset protection! This tactic not only reduces the taxes you owe but also shields you against potential legal issues that could arise from creditors.

Here are some smart investment options to consider:

Insurance

Insurance is a necessity that provides financial security when life throws you curveballs. Life, home, and automobile insurances are some of the most common types available; you can buy them through your employer or directly from an insurer to protect against loss of income resulting from disability or illness.

Estate planning

Estate planning helps ensure that your hard-earned assets are distributed in a way you desire after you’re gone. Through proper planning, not only can these wishes be realised but it could also save your family and beneficiaries from painful estate taxes down the road.

Home warranty

Owning your first home is an exciting chapter in life, but it comes with some unexpected costs. Investing in a home warranty can give you peace of mind by providing protection against those unplanned repairs and replacements that suddenly pop up. If you’re interested in learning more, check out this guide on the best home warranty for first time buyers.

Smart investment tips for parents

In addition to the investment options we’ve discussed, there are some general tips that every parent should consider when it comes to smart investing:

- Start early: The earlier you start investing, the better. By starting early, you can take advantage of compounding interest and give your investments more time to grow.

- Diversify your portfolio: Diversifying your portfolio can help reduce your risk and ensure that you’re not relying too heavily on any one investment.

- Keep fees low: High fees can eat away at your investment returns over time. Look for investment options with low fees, such as index funds and ETFs.

- Stay the course: Investing is a long-term game. Don’t panic and sell your investments during market downturns. Instead, stay the course and keep investing consistently over time.

But what does this all mean for smart investments for you?

Every parent’s goal is to create financial security for their family. But how do you make sure that your loved ones have a bright future? A good start is by investing in multiple resources: education, real estate, the stock market, and even your own health!

To maximise the potential return on investment, it’s important to begin early with diversified portfolio options and keep fees low. By taking these measures into account when making decisions about finances – along with staying focused – you can help secure abundant long-term wealth for your family.

We hope that this is helpful – this is just a tips article, and it doesn’t constitute financial advice of course. For other money-saving ideas, do check out some of the other budgeting printables we have on the site:

Money saving printables on KiddyCharts

Here are some more ideas and printables for saving money on KiddyCharts - we hope that these help you out a little bit more with those money worries.

Mortgage deposit tracker: 5 signs you're ready to buy not rent the family home

Get that mortgage sorted with this deposit tracker - and easy way to save for that perfect house.

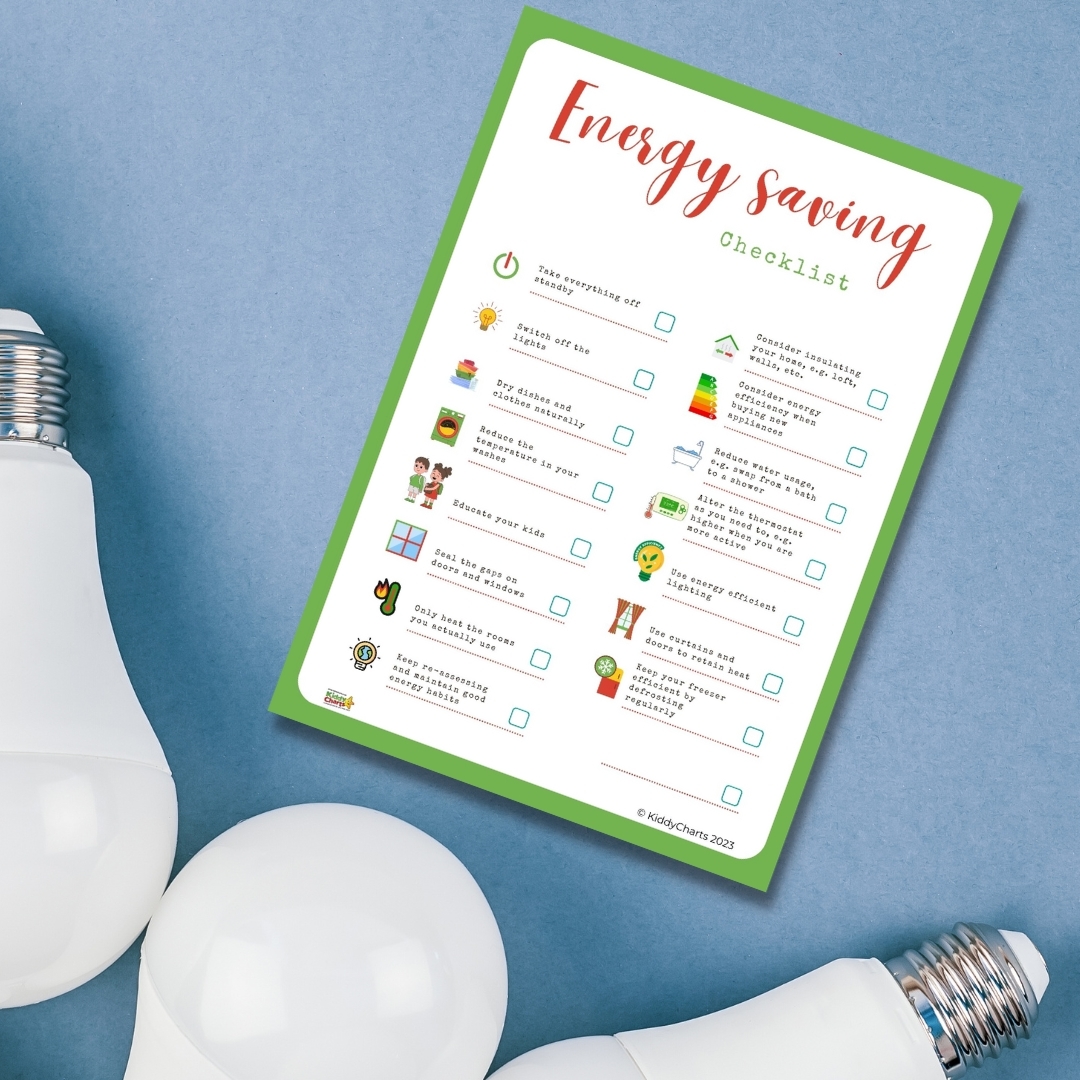

How to conserve energy at home: Includes 15-point checklist

Some ideas for conserve energy in the home, which of course, will save you money.

Money saving challenge printable: How to save 1000 in a month

Save yourself 1000 in a month with this easy to use and very cool printable idea.

5 tips for making eating out cheaper: Including budget envelopes

Eating out doesn't HAVE to be hard to do - here are some budgeting envelopes to help you save for those nights out and other ideas around the house.

Raise a saver not a spender with these FIVE money saving activities

More tips for raising a money saver, and not someone that spends whenever they can!

Here are some thoughts from other sites too:

Budgeting ideas from outside KiddyCharts

Here are some more ideas for budgeting that we hope that you will find useful.

Frugal Tips To Save You Money When You Shop

Shopping can be tough when you need to save money - so here are some ideas to help you save while you are going around the shops from Miss Tilly and Me.

5 Fun & Educational Budgeting Games for Kids

Budgeting is a really important skill for kids to learn. So here are 5 games that your kids can play to help their budgeting skills.

How to create and maintain a family budget

Finally, it can be hard to know where to start when you are looking to create a family budget. So here you go - some more ideas for you to take a look at!

Do sign up to our newsletter if you like what you see as well:

Thanks for coming to see us and we really hope you are back soon.

Helen

This is a collaborative post.