In today’s economy, it’s more important than ever for families to track their spending and adhere to a budget. This single family budget planner is designed to help families organise their finances a little better, identify savings opportunities, and reach their monetary goals during these challenging times. There are various different savings calculators out there that can help you see how your budgeting fits in with any savings goals you have. These complement this printable really well to give you a comprehensive picture of your family’s finances.

This is a collaborative post.

Why do families need a family budget planner and a strategy for budgeting

What’s the point of all this we hear you ask? Well, there are a number fo reasons that a budget planner can help you as a family, particularly if you are working together to create it:

1. Manage expenses as a team

Having a centralised place to track all income sources, bills, and variable expenses fosters open and honest communication between parents about the family finances. Working together as a team makes budgeting feel less restrictive and helps ensure everyone sticks to the plan. You don’t have to share everything of course, just what you are comfortable with. Perhaps there are sheets for each child, depending on their age, and you just share what is relevant to them?

The older the child, the more you can share. This isn’t about creating anxiety around finances for children, but more abour educating them on what budgets are.

perhaps pick a specific topic area, and then do the planning around that.

Something that can work well, is using lunch food as an example. This helps kids to both understand the costs of items, and where they can make savings too, such as not buying a drink at lunchtime, but taking in their own water. Of course, this is much greener too 😂

2. Balance competing priorities

Today’s families have many expenses competing for their limited funds. From housing costs, groceries, transportation, childcare, activities, clothing needs, and more, families must allocate their money wisely to what is most important. This planner provides visibility into the family cash flow so you can find the right balance.

Keep one for yourself, while sharing the personalised ones for the kids!

4. Save for financial goals

Building up savings is crucial, even when money is tight. Small lifestyle changes that free up funds can add up substantially over time. Consistently monitoring your budget makes it easier to save for family goals like an emergency fund, vacation, college, or new home. Tracking savings progress also helps teach kids positive money management habits.

5. Adapt to changing circumstances

Family budgets need flexibility to accommodate changing circumstances like a job transition, move, new child, or other life event. Using the planner on a monthly basis makes it easy to adapt your spending plan to evolving family needs and income fluctuations.

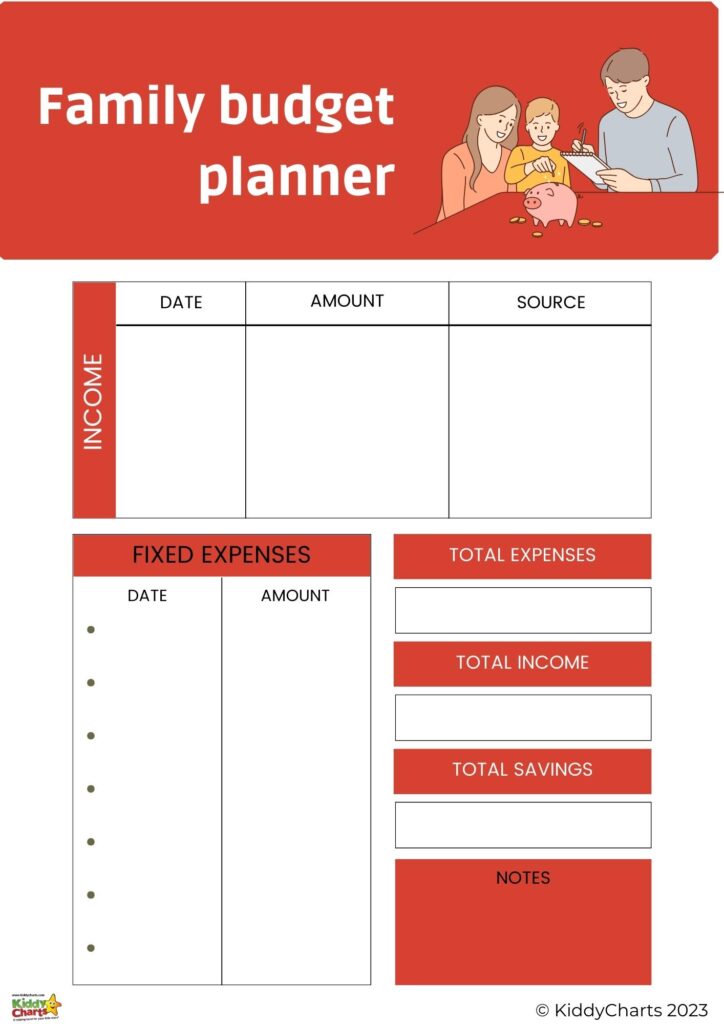

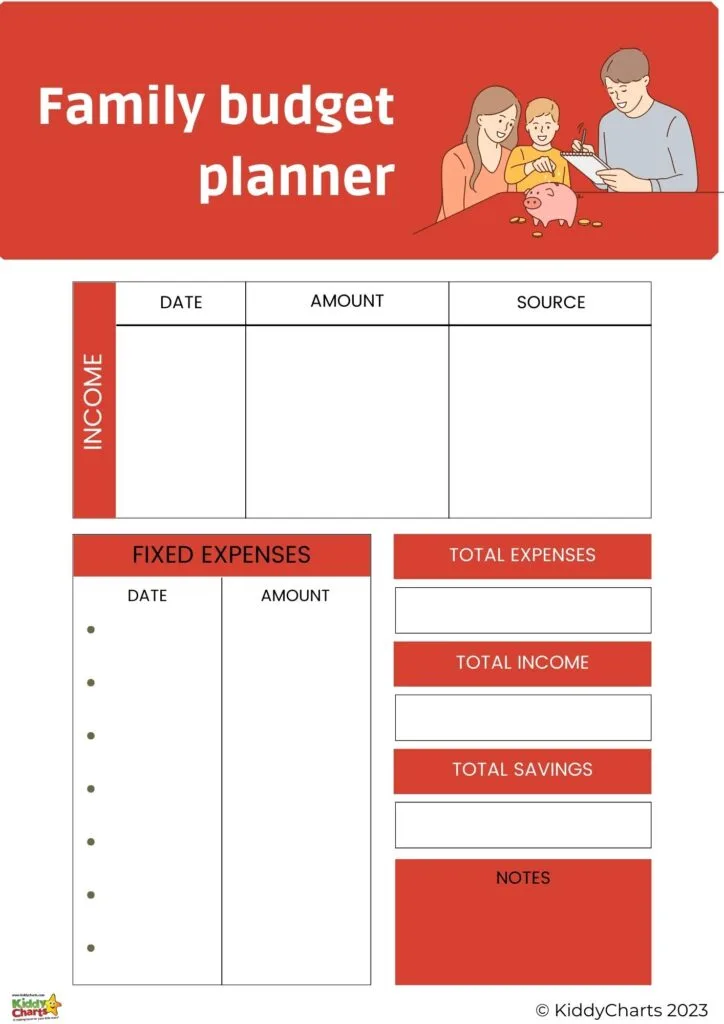

Understanding the printable budget planner pages

We have, as always got a couple of pages for you within this printable, with a few different sections for you:

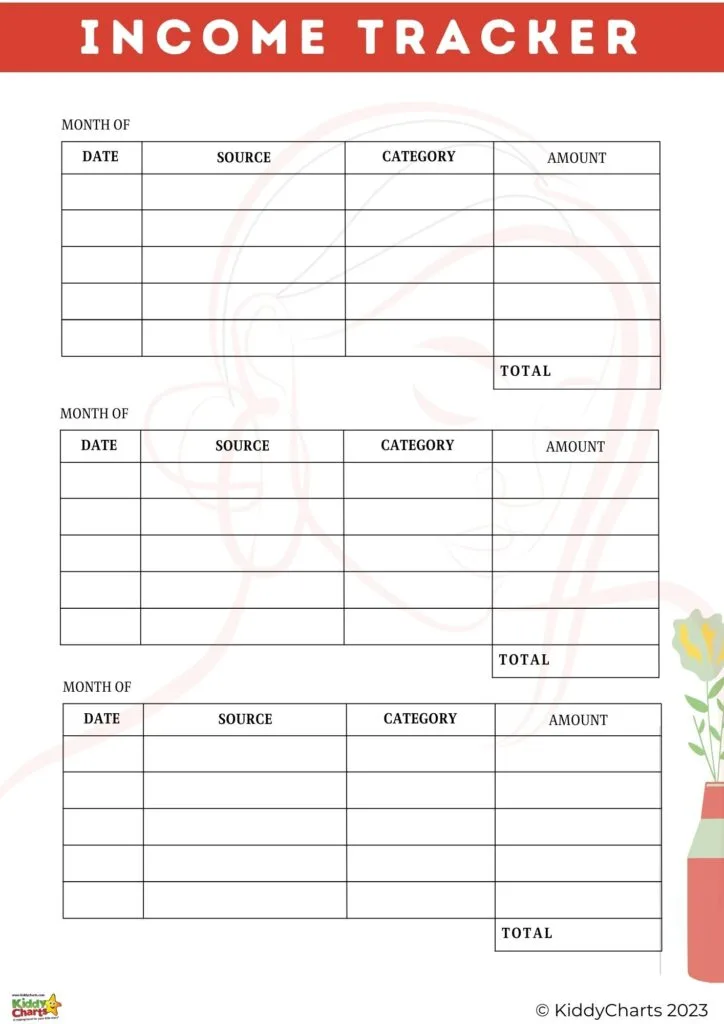

Income tracker

On this page, record all income coming in each month with dates, sources, and amounts. Be sure to include salaries, government assistance, child support, investment/interest income, side jobs, and any other monies coming in. Tally up the total monthly income.

Expense tracker

Use this sheet to break expenses down into common categories like housing costs, groceries, childcare, children’s activities, clothing needs, transportation, utilities, fuel, and miscellaneous costs. Add up the category totals monthly.

Savings tracker

Calculate your total monthly savings by subtracting your overall expenses from the total monthly income. Compare this to your family’s target savings number to stay motivated.

To download this planner, just click on the button of the image below:

Additional tips for family budgeting success include:

- Involve kids in age-appropriate ways – like tracking savings progress. Teaching money skills early pays off tremendously,

- Set family meetings to review the budget and spending goals. Make budgeting a regular conversation. However it IS important not to make kids anxious about money, so do the meetings in a light-hearted way. get the Monopoly money involved 😂,

- Build in rewards when goals are met, like a family fun day after hitting a savings milestone, and

- Always avoid guilt or blame if mistakes happen. Focus on working together to get things back on track.

With some diligence and teamwork, this comprehensive family budget planner can help your family master your finances and achieve your money goals, even when times are tough. Consistent tracking provides visibility and control that makes all the difference.

if you are looking for more printable around money, we have a few on the site that are worth taking a look at:

Money saving printables on KiddyCharts

Here are some more ideas and printables for saving money on KiddyCharts - we hope that these help you out a little bit more with those money worries.

Mortgage deposit tracker: 5 signs you're ready to buy not rent the family home

Get that mortgage sorted with this deposit tracker - and easy way to save for that perfect house.

How to conserve energy at home: Includes 15-point checklist

Some ideas for conserve energy in the home, which of course, will save you money.

Money saving challenge printable: How to save 1000 in a month

Save yourself 1000 in a month with this easy to use and very cool printable idea.

5 tips for making eating out cheaper: Including budget envelopes

Eating out doesn't HAVE to be hard to do - here are some budgeting envelopes to help you save for those nights out and other ideas around the house.

Raise a saver not a spender with these FIVE money saving activities

More tips for raising a money saver, and not someone that spends whenever they can!

Here are some more ideas off site as well:

Budgeting ideas from outside KiddyCharts

Here are some more ideas for budgeting that we hope that you will find useful.

Frugal Tips To Save You Money When You Shop

Shopping can be tough when you need to save money - so here are some ideas to help you save while you are going around the shops from Miss Tilly and Me.

5 Fun & Educational Budgeting Games for Kids

Budgeting is a really important skill for kids to learn. So here are 5 games that your kids can play to help their budgeting skills.

How to create and maintain a family budget

Finally, it can be hard to know where to start when you are looking to create a family budget. So here you go - some more ideas for you to take a look at!

Do sign up for our newsletter if you like what you see as well:

Thanks for visiting us, and we hope you will come back again soon,

Helen